You Get What You Pay For

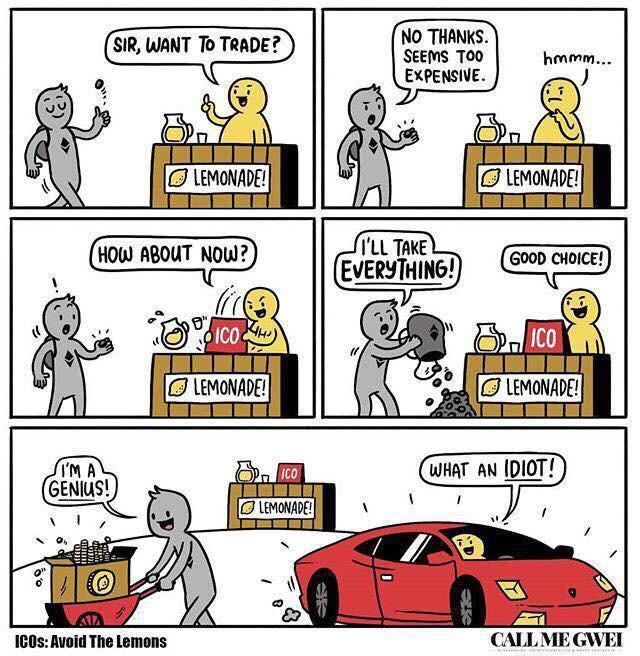

While I was freelancing in the blockchain space during the token sale boom of 2017 the velocity at which the number of requests for smart contract developers (specifically for ICO) was concerning. However, even more alarming was the number of these contracts for bid which had descriptions remarkably close to these exact terms:

- skill level required: entry level or intermediate

- pay: paid in tokens!

- max budget: less than $500

I can't help but suspect that many of these token sales did not fare so well. When groups are spending 6 figures on marketing but less than a grand on the smart contract development you end up with fraud, theft, and failed sales. For goodness sake, the crowdsale contracts are going to be funneling potentially millions of dollars. Is that really where you should be cutting corners?

Furthermore, sorry but accepting payment in the form of the currency I am building for you is not going to be acceptable. Someone making widgets is unlikely to accept payment in the form of the same widgets they are producing.

Smart Contract Visibility

The smart contracts for your ICO should be public prior to the start of the sale. There is no reason this is not possible and keeping them private is a huge red flag at least to those who share my mindset.

Much of the technology that makes your ICO possible is open source. So why deviate from that social value unless of course you are trying to hide something?

Here are 2 of the things that often happen to publicly available crowd sale contracts:

- People look at them and, in some cases, even provide feedback or point out issues that might jeopardize the success of the sale.

- It gives your team added credibility and is a sign that there is at least development experience involved. Especially if there is a commit history showing the development that got them to their current state.

Baseline Transparency

Here are questions that should be answered at the bare minimum by entities raising capital via an ICO:

- What should the valuation be?

- How do I make sure to get tokens in the hands of as many long term holders or users as I can?

- What % of the protocol should be sold?

- How much capital is necessary?

- How many rounds of token sales should there be?

Unfortunately, this is far from what has sadly become commonplace.

ICO Company Valuation Parameters

Product

- solves existing problem or creates the problem to solve

- readiness

- competitive advantage

- market size

- space in market

- innovation and IP

Use of Blockchain

- blockchain advantage

- precautionary measures

- need for a custom token

- intrinsic value of token

- contribution to the blockchain economy

- compliance

Whitepaper

- comprehensiveness

- readability

- transparency

- business plan

- technology

Development Roadmap

- concreteness

- feasibility

- vision

- maturity

- current position

Business Model

- concreteness

- feasibility

- clarity

- cost effectiveness

- legitimacy

Company and Team

- company state and foundation

- founders

- core team

- advisory board

- blockchain talent

- development talent

- business talent

- legal counsel

- overall skill set

Let's Look at Some Recent Examples

Medical Chain.

Excerpt from whitepaper:

Moreover, using tokens means that considerable amounts of money are not spent on payment settlement mechanisms and their ensuing fees in individual countries. Patients will use tokens to pay for the hosting and storage of their record on our private blockchain powered by Hyperledger Fabric. Tokens will be used to pay for Medicalchain to request and populate a user’s record for them. Registered doctors and other healthcare professionals will be rewarded tokens to remotely review medical information and provide advice or a second opinion on a case. Pharmaceutical and other research companies will reward patients in tokens by having time limited access to their health record for research and experimental purposes.

- Patients will pay to store their records on a private blockchain powered by Hyperledger using tokens issued on Ethereum but paid for by BTC sent to an escrow wallet...

- Patients can pay to have their data entered for them...

- MDs will be rewarded in tokens to review medical records...

- Pharma companies will pay patients tokens to access their personal health data.

Well, other than the tokens seemingly running on a different blockchain, one is left wondering who will truly benefit from this project should it be implemented as described.

I have to give credit here since the major problems with implementation are at least recognized:

- Patients will have to learn how to use their private key properly. They may wrongly assume these can be easily changed.

- Stakeholders will need to learn how to use blockchain technology.

- Legacy systems will either have to be tweaked or remade.

WCX

Pre-sale discounts, quantity bonuses, 87% float available for trading upon ICO completion. The token is ERC20 compliant as per the website, but a quick search yielded no contracts to review so I cannot verify this claim. Not going to spend any more time on this one but if you are a bargain hunter you might keep this on your radar or just set some buy orders as close to zero as you can.

At least they have a working product for viewing.

https://wcex.co/trade/LTCBTC

And it looks nothing like GDAX (Coinbase).

https://www.gdax.com/trade/BTC-USD

</sarcasm>

BlockEx

Institutional pre-sale 50% discount...

Public pre-sale 25% discount...

...Well at least only 55% are being sold in the ICO

Let's take a look at the business model described in the Whitepaper

Their proposal is to establish a standard for ICOs that is legally compliant (KYC/AML/etc.) and follows existing industry standards.

They continue to point out several issues that have become quite rampant in the ICO world such as:

So far, the buying of tokens in the ICO market has been motivated by ideas presented in white papers. These ideas are blank cheque promises that token holders have no route to verifying. Since the ICO market is not a fully regulated market, these promises are not bound by law, and not fit for legal action.

Hmmm... actually sounds like a great idea.

The primary value of the DAXT is its utility in accessing the ICO

pre-sale feature on the ICO Market. Its secondary value is driven by its investment value.

This is starting to sound more like a pay-for-presale model than an ICO model albeit the platform will allow for this once built. As of now, the GitHub repo for Blockex has only cobwebs. The last couple pages make me think the writers were getting tired. Excerpts:

All our products have one goal: to centralize the currently fragmented financial securities market using the blockchain, a decentralizing technology.

-_-

The exchange is HFT capable with institutional connectivity via API FIX and ITCH protocols and is digital asset framework (Blockchain/DLT) agnostic.

This will be appealing to some I imagine. But understand this: The people who have spent the past few years building this technology did so because of predatory practices like HFT. (yeah not all of it is bad but the good guys let’s call them liquidity providers; if that's not good enough for you then tell me who invented PFOF and defend that concept still being in practice).

Back on topic. This technology, um, which you are using to raise capital to protect clients from people raising capital with "ideas [that] are blank cheque promises that token holders have no route to verifying"...

...but at least institutional investors can get a 2 for 1 special making slippage during the selloff less of a risk.

Jesuscoin

jesuscoin.network for more info.

I came across this after someone had posted a link to the site on LinkedIn. I have not laughed that hard in some time. Only a picture of Cardinal Glick (George Carlin) unveiling the Buddy Christ from the movie Dogma would have made it better. I might have given a dollar or two but sadly the ICO is long over at this point.

Update July 2020: Sadly, many of these ICOs discussed here have bit the dust. Including Jesus Coin.