Cracking down on scams is something we can all agree on. Just recently I read about a particular scam that consists of the issuance of derivative contracts for a particular cryptocurrency that settle in cash even though the cost of carry is near zero. The spot prices calculated in such a manner that serves only to promote arbitrage. Of course, this is all with data sourced for free but turned around and sold for a fee.

The SEC, CFTC, etc., are only relevant in this decentralized movement as a means of protecting investors from falling for frauds (losing fiat) created by some of these predatory or fraudulent actors. Here is the rundown:

The What

Quick stats for the CBOE and CME futures:

| Issuer | Symbol | Listing Date | Multiplier | Settlement | Data Source |

|---|---|---|---|---|---|

| CBOE | XBT | 12/10/2017 | 1 BTC | Cash | Gemini Auction Price |

| CME | BTC | 12/18/2017 | 5 BTC | Cash | CME CF BRR** |

"The BRR is designed by CME Group and Crypto Facilities Ltd (who at one point were offering 50x leverage contracts :o ) and is price of one bitcoin as of 4:00 p.m in USD."

Rather misleading statement when the calculation is actually the "Aggregation of trade executions occurring on Constituent Exchanges between 3:00 p.m. and 4:00 p.m. London time"

The Why

Note: the BRR is different from the BRTI (bitcoin real-time index). If you have not already realized that the name of the game here is selling data feeds to "professional" traders. Data which of course is FREE from the exchanges that supply data to create this "priced" data.

The How

The BRTI is calculated by aggregating the order books from the constituent exchanges (using free data) and then running it through an rather simple but so overly technically described that no one cares to read it again formula part of which is a "normalized probability density of the exponential distribution up to the utilized depth" to obtain the BRTI. The CME coincidentally just raised their 2018 data rates to $24,000 and $18,000 for real-time and historical data, respectively.

Enjoy those no fee days while they last.

http://www.cmegroup.com/trading/files/bitcoin-real-time-index-methodology-version-2.pdf

The Who

CBOE

- Gemini Auction Data (Not actual spot price...)*

The constituent exchanges used to price the CME futures? Here you go:

- Bitstamp

- GDAX

- itBit

- Kraken

Side Note: Anyone remember the GDAX flash crash? You should because that was no accident. It was a very profitable, and impressive, trade orchestrated by a seasoned trader or group of traders. You can read more on that here

CME Reference Rate Methodology

The Cost

The Reason I Think This Is All Very Bad

CASH SETTLED.

- This means LESS volume for actual Bitcoin trading not more! Not necessarily a bad thing but if anyone claims this is anything other than a glorified gambling game please remind yourself that hedging should not be necessary when these institutions should be not be investing client funds in Crypto.

Next thing you know we will start having to pay for Crypto price data. Oops already happening.

- Using data obtained for free or nearly free and then charging thousands of dollars for direct access. This is actually where a good bit of the profit from this SCAM is going to come from. And if you pay for data you can get for free for futures contracts that have even LESS VALUE than bitcoin itself then you might want to also buy some of this vaporware.

I'm not even going to address the following issues that WILL start to become problems:

These futures will rarely have the same spot price of the underlying. Welcome HFT and latency arbitrage. The manipulation is about to get real.

The Funeral for Bitcoin

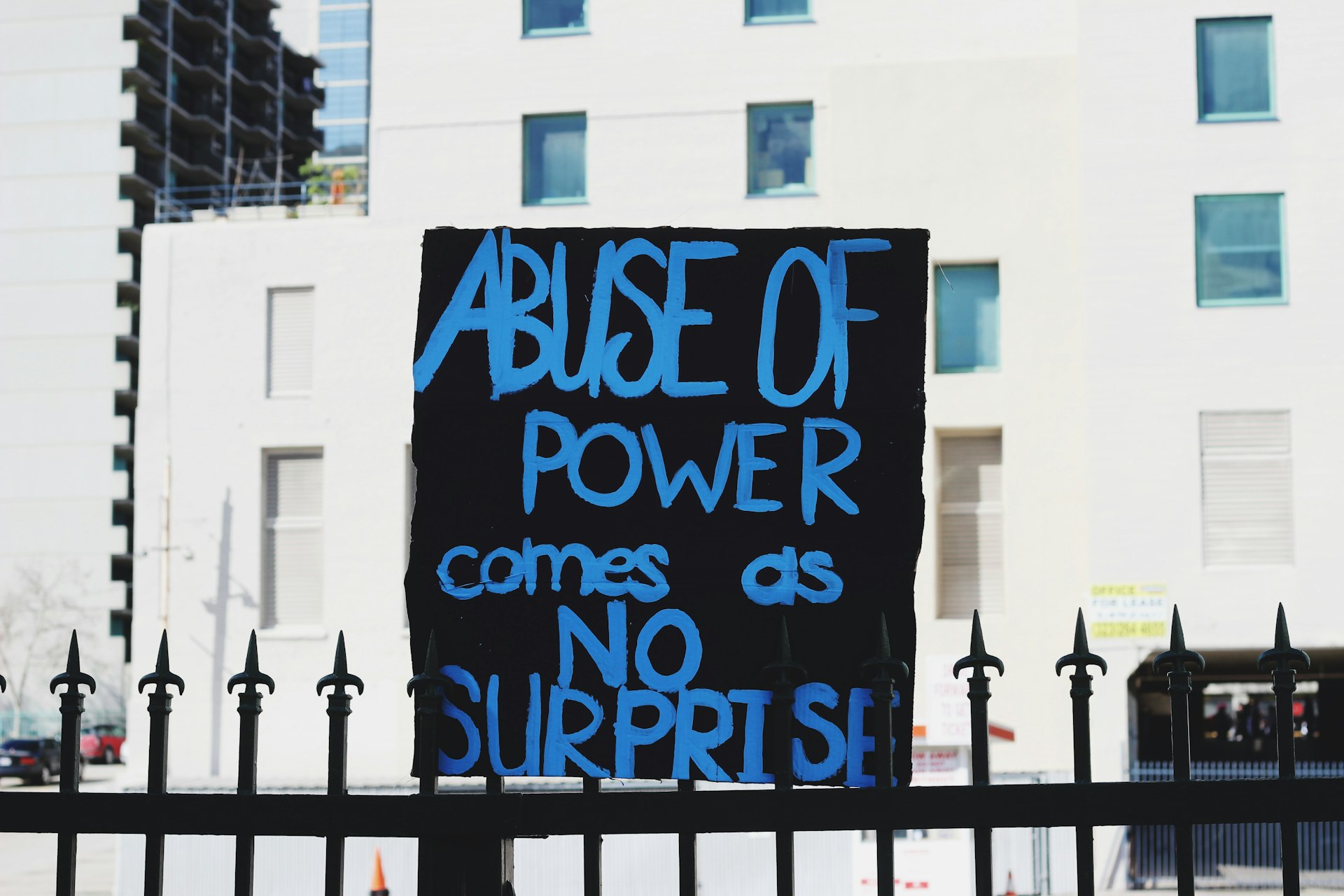

A digital currency created in order to eliminate greedy middlemen ultimately comes to be controlled by those very same middlemen because of the same greed.

Sad. But at least when Wall St. goes to sell off the market top, they are going to be the ones holding the bag since the rest of America will have been buying crypto and tokens. At least, that is the fairy tale I tell myself.

I really hope the practices that have caused the US to be so far behind do not make their way into what could be an incredibly positive change in how societies can function. Please correct me if I'm wrong but I think the US is the only market that allows Payment For Order Flow (which was invented by Bernie Madoff and deemed harmful to clients by EU studies a couple of years ago).

Same with the patent system. The number of banks and corporations patenting one thing after another that already exists in an open source repository on GitHub simply because that is how it works here explains why terms such as patent troll exists. All this fear driven defense does is stifle innovation and perpetuate the unrest.